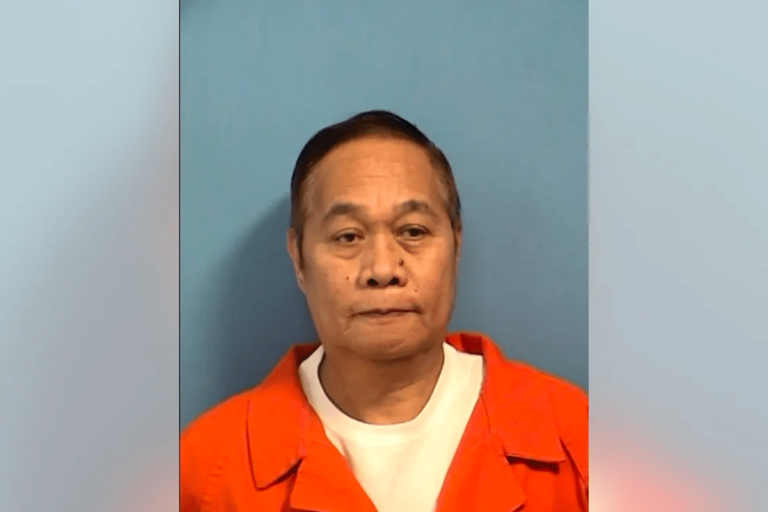

Are Illinois Residential Care Facilities Adequately Regulated? Exploring Oversight Amid Abuse and Neglect Incidents

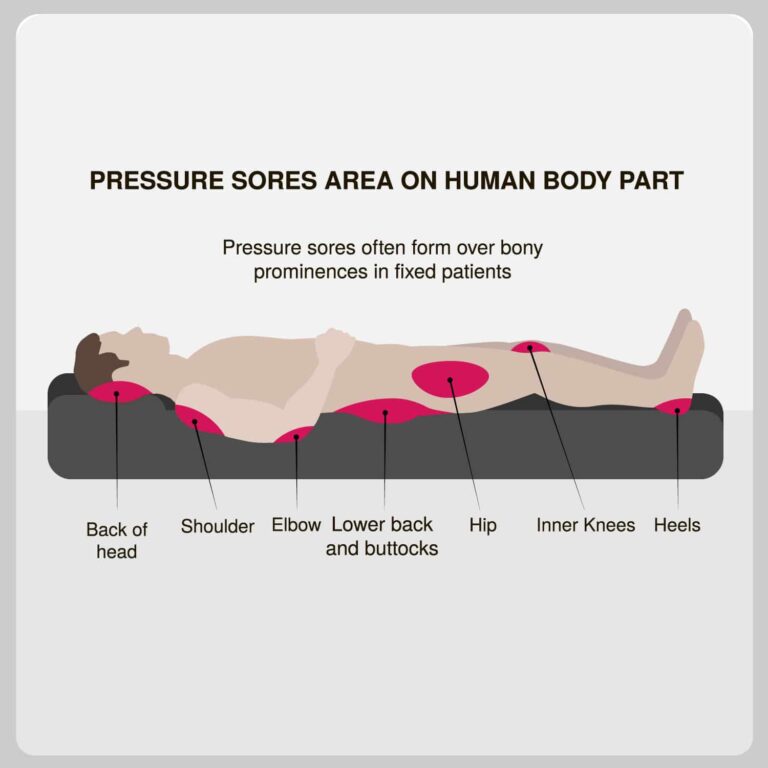

Nursing home regulations aim to guarantee that residential facilities provide safe, sanitary, home-like environments where residents receive quality care. Inadequate regulation in nursing homes has